The rapid growth of fintech and digital payment platforms has transformed how people send, receive, and manage money. From mobile wallets and UPI apps to neobanks and payment gateways, financial services are becoming faster and more accessible than ever. However, this digital revolution also brings increased risks of fraud, identity theft, money laundering, and regulatory non-compliance.

This is where document and KYC (Know Your Customer) verification plays a critical role. For fintech and digital payment companies, robust KYC verification is not just a regulatory requirement—it is essential for building trust, ensuring security, and enabling scalable growth.

In this article, we explore the importance of document and KYC verification in fintech, how it works, key benefits, challenges, and best practices for modern digital payment businesses.

What Is Document and KYC Verification?

KYC verification is the process of verifying a customer’s identity using official documents and personal information before allowing access to financial services. In the fintech and digital payments ecosystem, KYC typically involves:

- Identity verification (name, date of birth, address)

- Document verification (government-issued ID)

- Biometric or facial verification

- Ongoing customer due diligence

Document verification focuses on validating the authenticity of identity documents such as:

- Passports

- National ID cards

- Driver’s licenses

- PAN cards, Aadhaar cards (India)

- Proof of address documents

Together, document and KYC verification help fintech companies confirm that users are genuine and legally eligible to use financial services.

Why KYC Verification Is Critical for Fintech & Digital Payments

1. Regulatory Compliance

Fintech companies operate under strict regulations such as:

- AML (Anti-Money Laundering)

- CFT (Counter Financing of Terrorism)

- RBI, SEBI, PCI-DSS, FATF guidelines (depending on region)

Failure to comply with KYC regulations can result in heavy fines, license suspension, or shutdown. Strong KYC processes ensure compliance with local and global regulatory standards.

2. Fraud Prevention

Digital payment platforms are prime targets for:

- Identity fraud

- Account takeovers

- Synthetic identities

- Money laundering

Document and KYC verification help detect fake or stolen identities early, significantly reducing fraud risk.

3. Building Customer Trust

Users are more likely to trust fintech apps that prioritize security and data protection. A secure, transparent KYC process reassures customers that their money and personal data are safe.

How Document and KYC Verification Works in Fintech

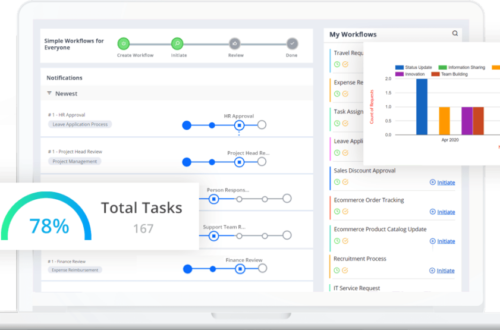

Modern fintech platforms use digital and automated KYC solutions to verify users quickly and securely.

Step 1: Customer Onboarding

The user submits personal details such as:

- Full name

- Date of birth

- Address

- Phone number or email

Step 2: Document Upload

The customer uploads identity documents using a smartphone or webcam. Advanced systems support:

- OCR (Optical Character Recognition)

- Auto-capture and quality checks

- Tamper detection

Step 3: Identity Verification

AI-powered tools verify:

- Document authenticity

- Matching details across databases

- Expiry dates and security features

Step 4: Biometric & Liveness Check

Facial recognition and liveness detection ensure the user is physically present and matches the document photo, preventing spoofing and deepfake attacks.

Step 5: Approval & Monitoring

Once verified, the account is activated. Ongoing monitoring flags suspicious activity for enhanced due diligence.

Benefits of Digital KYC Verification for Fintech Companies

Faster Customer Onboarding

Automated KYC reduces onboarding time from days to minutes or even seconds, improving conversion rates.

Reduced Operational Costs

Digital KYC eliminates manual verification, paperwork, and physical branch visits, significantly lowering costs.

Scalability

Automated document verification allows fintech platforms to scale effortlessly as user volumes grow.

Improved User Experience

A smooth, mobile-friendly KYC process enhances customer satisfaction and retention.

Common Challenges in KYC Verification

Despite its advantages, fintech companies face several challenges:

1. User Drop-Off During KYC

Lengthy or complicated KYC processes can frustrate users and lead to abandonment.

2. Data Privacy & Security

Handling sensitive personal data requires compliance with data protection laws such as GDPR and ISO standards.

3. Fraudsters Using Advanced Techniques

Fraudsters increasingly use forged documents, deepfakes, and synthetic identities, requiring advanced AI-based detection.

Best Practices for KYC in Digital Payments

To overcome challenges, fintech companies should adopt the following best practices:

- Use AI and machine learning for document verification

- Implement risk-based KYC instead of one-size-fits-all

- Ensure end-to-end data encryption

- Provide clear instructions to users during onboarding

- Regularly update KYC processes to meet regulatory changes

The Future of KYC in Fintech

The future of document and KYC verification in fintech is moving toward:

- Video KYC

- Biometric-first verification

- Decentralized digital identities

- Continuous KYC monitoring

These innovations will make identity verification more secure, faster, and user-friendly while maintaining compliance.

Conclusion

In the fintech and digital payments industry, document and KYC verification is the foundation of secure, compliant, and trustworthy financial services. As digital transactions continue to rise, fintech companies must invest in advanced KYC solutions to prevent fraud, meet regulatory requirements, and deliver seamless user experiences.

By adopting modern, AI-driven KYC verification systems, fintech businesses can protect their platforms, build customer trust, and scale confidently in an increasingly digital financial landscape.